Hybrids powering lean sales drive

/Toyota New Zealand’s sales boss describes how covid has reshaped a business in which battery-assistance has become vital.

DAYS of carrying two to three months’ inventory are likely over for Toyota New Zealand and its Lexus premium division; now it’s common for 98 percent of their cars to be sold before they reach New Zealand.

“We used to measure the number of stock terms per year, and if you turned over your stocks three or four times, that was a good metric.

“We're turning our stock every month. We basically have no inventory at the end of the month.”

Such has been the impact of the coronavirus pandemic on the largest performer in the new car market. Covid-19 has killed most old practices.

Chance of any ever being brought back to life? From tenor of talk from Toyota New Zealand general manager of sales Steve Prangnell (above), speaking to media at introduction to Corolla Cross – a sports utility-styled five-seater that, as the name says, is the first Corolla with crossover potential - the chances of that would seem to be slim.

“Long established business practices and assumptions, you know, on how the industry operates have been completely overturned.”

The Palmerston North operation always had good handle on its business, yet now it has all the greater understanding of the global automotive manufacturing and distribution supply change.

“On the supply side, Toyota and all automotive manufacturers have experienced that chaotic effect of different countries getting Covid at different times with impact on different paths of the supply chain and allocation.”

Supply disruption has been such that sales forecasts have become all but pointless. “For example, this year we started with a sales forecast of 38,000 cars. By the end of the first quarter it was 35,000. By the end of the mid quarter it was 30,000. Now it is 33,000.”

Covid’s effect didn’t just impact on the assembly line but also with tier one suppliers, whose role it is to produce a specific finished component who, in turn, have been hit by their own suppliers being disrupted. Even when vehicles are built, they have to be delivered. Shipping disruptions are “just about a weekly occurrence for us,” Prangnell explained.

“New Zealand's at the bottom of all supply routes around the world. Our shipping is being affected weekly by a combination of delays in other countries (and) by congestion at New Zealand ports. Auckland constantly has ships waiting to come in.”

For all that, consumer demand for vehicles remains healthy, though thanks to Government’s new Clean Car regulation, which steps up on January 1 with the Clean Car Standard, and CO2 reduction targets, choices are changing. While the Hilux utility stood as Toyota NZ’s top sales performer last month, it’s also a high CO2 output vehicle. Some fleets that have been running the one-tonner are now determining lower emissions alternates, notably the RAV4 Hybrid, can perform the same duty, so they’re switching.

“From a retail side, agility in the speed of response to our customers has been the key thing that we've had to adapt.”

Longer wait times for new vehicles has become a norm. “When you're carrying three months of inventory on the ground, you could normally supply that car within two weeks. We are now running anywhere between six weeks and six months, depending on the car.”

While most consumers are happy to wait, some do walk, but not many. He suggests that’s because TNZ works hard to give them constant updates about the state of play.

“We've had to work really hard with our logistics company, our companies in terms of distribution internally and with our stores on new protocols and processes for staying in contact with our customers, either physically, you know, or by some sort of digital way.

“So it's quite a different business today than, than it, than it has been. It's happened very, very quickly. But, as they say, at times of crisis, there is opportunity. Despite lower total sales, the Toyota business has rebounded strongly in 2021 globally and locally.”

TNZ predicts the new passenger and light commercial market is on track to achieve 165,000 units this year, a stronger count than in the past two years. The supply constraints that hurt performance in the first quarter of 2022 to the point that Mitsubishi regained passenger leadership – for the first time in decades - are largely over and TNZ has returned to its traditional top spot for overall count, with expectation that it will be also be the top passenger brand very soon.

“We had a tough start, supply restrictions held our sales volume back quite significantly in the first sort of four to five months, but once supply became more consistent, we've been able to deliver strong volumes month on month for the last five months.”

TNZ has, of course, observed the pick up in interest in electrification but says it’s not just about pure electric cars but electrification in general. Though Lexus already has a battery-pure product in the market (UX 300e, which has just been updated to offer improved range) and will add a second next year with the RZ, a sister ship to the bZ4X that brings Toyota NZ into the battery-only sector, TNZ maintains that there’s much more logic in putting more focus into hybrids without mains-replenishment capability.

That’s why it has retuned its passenger lines to present almost purely with hybrid drivetrains, ironically a move that will be to detriment to the car that introduced the technology to the world. By year-end the Prius, a nameplate that has been in NZ for 28 years, will be gone from this market.

Corolla Cross only presents in 2.0-litre hybrid; the pure petrol models going elsewhere, including Australia, are not warranted here, Prangnell says, because they’d hinder the brand’s push to achieve the CO2 fleet averages Government has set. He says TNZ is on track to exceed the requirements not just for next year, but also 2024 and 2025 and has forwarded long-term sales plans to Japan.

As is, all Corollas are now hybrid and average CO2 from that family stands at 104 grams per kilometre, with expectation it’ll go up to 107g/km when the high-performance, non-battery assisted GR Corolla comes next year.

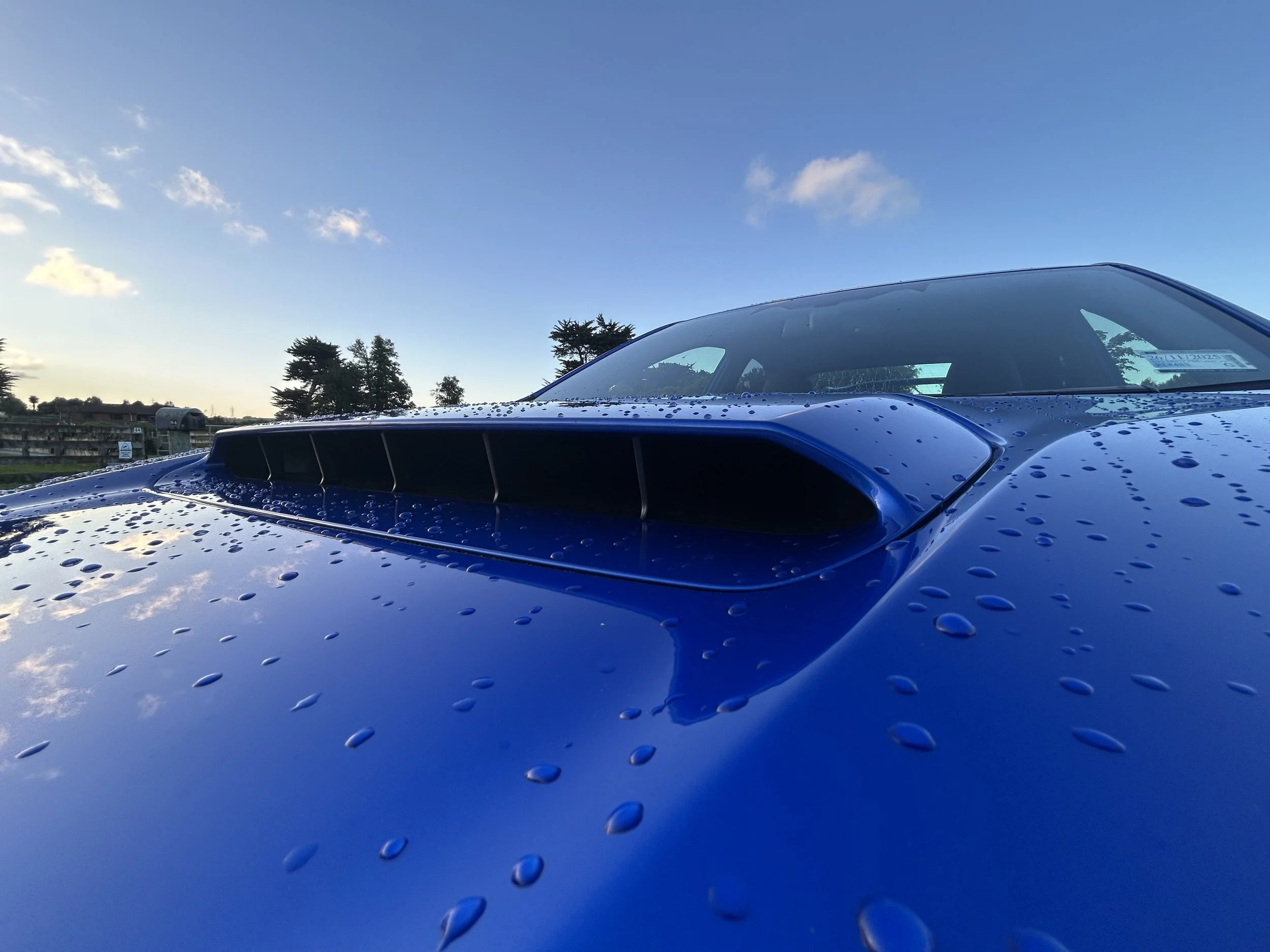

Going into the SUV sector is one of two big changes for Corolla, the other being that it has now departed from the sedan bodyshape that has been offered since the nameplate arrived in 1966, but it makes sense.

“Preferences have moved away from conventional models. SUV has become the most popular segment, making up 52 percent of all sales in New Zealand,” Prangnell reminds. And consumer trends support thought a hybrid Corolla Cross will work.

“Our mix of hybrid has risen from seven percent in 2018 to 38 percent last year. Year to date it's sitting on 36 (percent) but that's due to supply constraints around hybrid generally. It would be over 40 percent if we could deliver to our customer back orders.”