Dirty vehicle buying habits to return after clean year?

/The organisation speaking for new vehicle distributors says it’s hard to say if a big upsurge in battery car buying will keep on in 2024.

LAST year’s record uptake of new low emission vehicles suggests Kiwis understand importance of picking cleaner cars, but with regulation promoting this now gone, some might fall back into old habits, an industry high-up concedes.

With the Clean Car discounts and penalties now abolished, probability of consumer regression to some high CO2 emitting products in the short term is high, Aimee Wiley agrees. Likewise ongoing allegiance to enduring popular kinds that breached the old rules.

She heads the Motor Industry Association, an organisation that speaks for new car distributors.

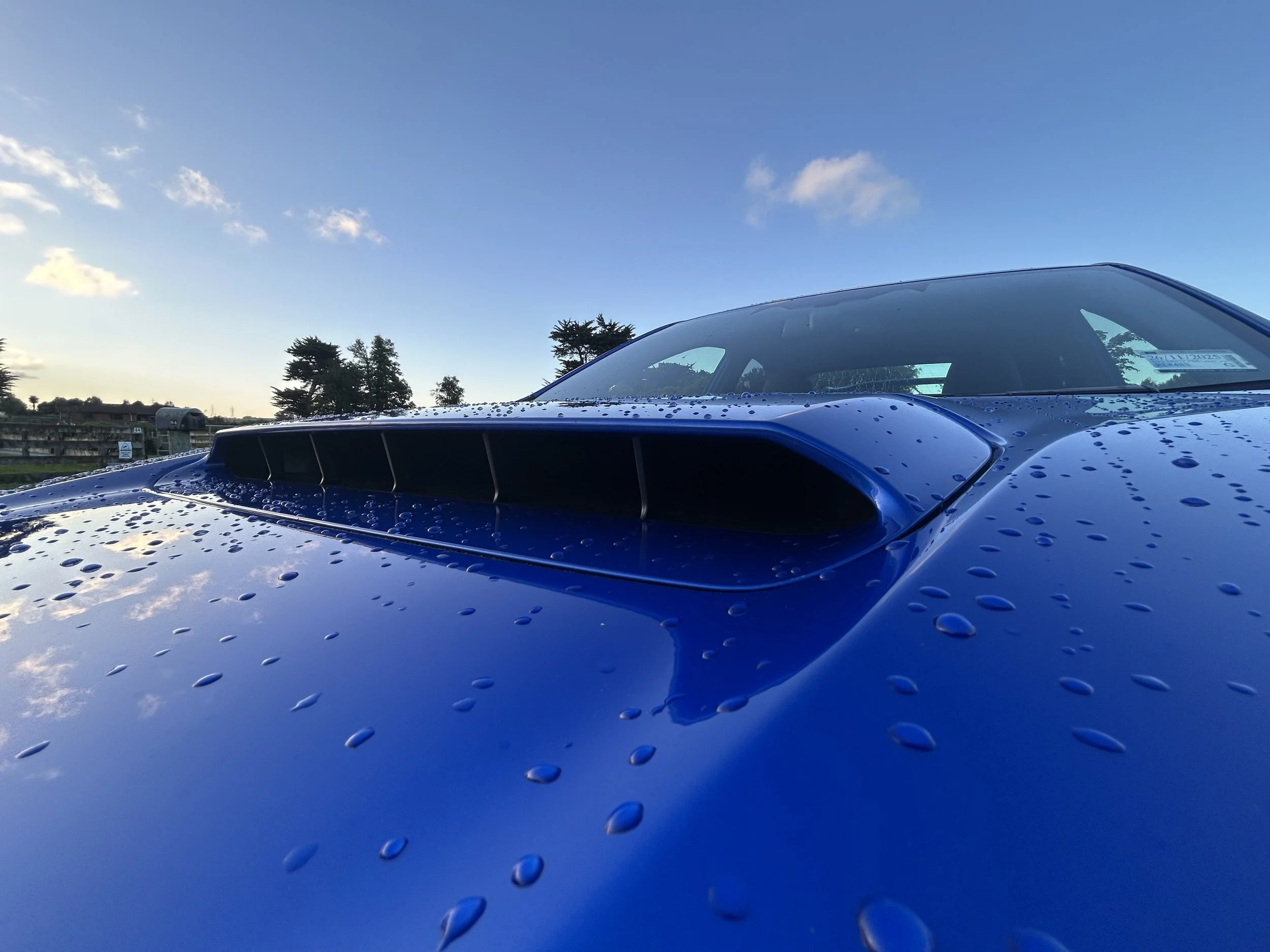

Top of the popular CO2 black listers are one-tonne utes, lead by the Ford Ranger which, even though it meets latest Euro 6 emission standard and had the cleanest of diesel choices (with the biturbo 2.0-litre) was still above the acceptable limit and so copped penalties adding thousands of dollars to recommended retails.

Those knocks were patently of no great consequence to buyers. Ranger was the top-selling light product of 2023. While the 9893 tally was down on 2022 and 2021, when it smashed 13,000 units, and take-up slowed from October - when the General Election’s outcome made clear the CCD was set to go - its eighth consecutive year of market dominance was nonetheless easily achieved.

The Blue Oval hauler sat 1136 registrations above the nation’s top-selling car, the RAV4, from Toyota New Zealand, which kept firm grasp as overall new car and light commercial market leader.

Ranger again accounted for more than 70 percent of Ford NZ volume, and without it the Blue Oval would be outside the top 10 performers.

Even so, it is making inroad with electric and electrified product as is the industry as a whole - data detailing last year’s trends, released by the MIA today, also signalled that Kiwi habits are now changing for eco good.

While total new passenger and light registrations were down on the past few years, the MIA cites 2023 as being the best year yet for battery electric products, with a 45 percent rise over 2022’s count.

While the electric involved total is still lower than the take-up of purely combustion engined cars - which had a 60 percent share, with 89,054 registered - national adoption of 59,952 new battery-involved vehicles, almost half being fully electric or plug-in hybrid - so, with enough battery assistance to run wholly or significantly on electric alone - is nonetheless being celebrated.

Leading the charge is Tesla, which with 4996 registrations makes history by being the first make to achieve as the most dominant electric choice with primarily New Zealand-new cars.

The Nissan Leaf, which has historically been on top, with tallies built predominantly on used import volume, was 181 units behind.

The Tesla Model Y (below) was the country’s best-selling new full electric, with 3936 sold, followed by BYD Atto 3 (3171) then MG MG4 (1793).

The top plug-hybrids, with lower counts, were the Mitsubishi Eclipse Cross, Mitsubishi Outlander and Kia Sorento, while the best selling mild hybrids were the RAV4, Toyota Corolla and Honda Jazz.

The electrified vehicle upsurge rounded out with a strong December, the last month for incentives, when low emissions types claimed 72.5 percent of the 9768 registrations.

However Wiley admits last month’s battery vehicle activity requires some circumspection, with thought it might have been less about actual consumer interest and more fuelled by distributors and dealers pre-registering, creating a used stock which they cannot legally on-sell for three months, a legislative requirement for rebate retention.

“We're still waiting on that data, but I know there's been a lot of demos put on.”

However, the MIA believes the increased sales for all of 2023 was driven by genuine demand. It also impresses that it’s all been due to passenger cars, as the most popular one-tonne utility format - four-wheel-drive, double cab - lacks battery technology, though that’ll change this year.

Announcement having coincided with a big global headline, that 2023 was Earth’s hottest year on record, enforces need for continued uptake of low emissions vehicles, Wiley says. Transport is considered a major contributor to Greenhouse gases.

But can Kiwis be expected to keep up any automotive eco-consciousness in light of the National-led coalition Government’s scrapping of the previous Labour administration’s Clean Car Discount (CCD) scheme?

“Kiwis are very climate conscious, and I hope that they'll buy the cleanest, safest car they can afford,” Wiley (below) offers. However, she also concedes forecasting buyer trends for 2024 won’t be easy.

On the one hand, she would like to think that uptake of low to no (full electric) CO2 vehicles will continue.

She reminds that while CCD is gone, distributors are hit by another low-emissions encouragement, the Clean Car Standard (CCS), which implemented a year ago.

This imposes another set of penalties, to tune of thousands of dollars, that will, she says, pass on to consumers.

“It'll be put on the price. And there's only so many people out there prepared to pay those high prices for those vehicles.

“You'll always have some people, but I'm hoping that over time as we transition from early adopters into mainstream, that consumers actually choose the lower emission.”

That’s the international direction and, like it or not, NZ is part of that journey.

“As we look into the future, product is going to become more and more lower emission or zero emission.

“And the importers are regulated by the CCS to only bring clean product.”

And yet? Her gut feel is that ute, van and heavy commercial sales will lift for the next few months; buyers had held off on traydeck purchases especially to avoid paying a penalty they knew was set to be axed by December 31 .

At same token, though, there’s an optimism the clean car interest will withstand the loss of incentives.

“I think consumer preferences have changed. I think that, without the incentive, you'll see a lot of competitive pricing in the future.

“When we start to see the price of lithium-ion batteries come down, the price points of those vehicles should come down too. So I think it's going to get a lot more competitive in the light passenger.”

Insofar as utes go - can ever wean from those? While most are in formats that patently best suits recreational use are bought most, the MIA continues to maintain utes are bought our of necessity, and for work.

Wiley says it’s important to keep in mind that more environmentally-attuned one-tonners are coming.

“We know one electric ute is coming this year, and I expect to start to see more hybrids and electrified versions from maybe late this year, but definitely next year and the year after.”

For the next few months, she contends, it’s probable there will be a spike in diesel ute registrations simply because the fees have gone, “but I think it’ll be a temporary thing.”

As much as anything else, consumers are becoming more aware of heightened running costs. That’s an aspect that will inspire greater interest in impending lower emission product.

The challenge with electrified ute options will be cost.

“The price differential between a internal combustion, a petrol and diesel ute, and a battery-electric ute will be quite steep.

“So that's where we're going to have to get creative working with the Government to try and come up with some form of alternative incentive to get people in them to keep our emission lowering trajectory going.

“The MIA have always said that we support the progression towards carbon-neutral as quickly as possible in the transport fleet.”