Ute boom goes bust, but perhaps not for long

/Has Clean Car instantly altered buying trends, or are there other reasons why ute demand plummeted in April?

‘UTE tax’ hit on April 1 and ute interest last month all but died – but though one-tonne traydecks barely influenced new vehicle registrations and didn’t make the top three for the first time in more than a decade, sellers don’t expect this to be a lasting trend and some question if the emissions penalties were even influential.

Introduction of Clean Car legislation, designed to clean up vehicle emissions by penalising poor performers and rewarding clean types, had impact on new vehicle buying trends last month, according to data and comment shared by the Motor Industry Association.

The organisation that speaks on behalf of most new vehicle importers says the light commercial sector, into which utilities – which Government cites as being particularly dirty - fall, achieved just 730 registrations, while the total commercial count came to 1220 units, a 72 percent decline.

Meanwhile sales of more eco-minded vehicles – particularly plug-in hybrids - bolstered. Yet overall, with 9756 new vehicle registrations notified. it was the weakest April in seven years.

Ute disinterest last month was forecast; as was a big splurge on buying the month before, when buyers moved to beat Clean Car Discount fees – which penalise any vehicle emitting more than 192 grams of CO2 per kilometre. The strength of that interest surprised. That 21,044 count for March was the strongest for any month of the year ever.

Utes held the high ground then; achieving the majority of 9841 light and heavy commercial vehicle registrations and three types – the Mitsubishi Triton, Ford Ranger and Toyota Hilux – were the country’s strongest-selling vehicles.

Those models barely blipped in the April count, but potentially not simply because fans didn’t want to pay a CO2 penalty, which no ute has avoided and which is now adding thousands of dollars to recommended retails.

Some say stocks were all but exhausted by the March rush. Said one involver: “If there was stock in March it was all registered (that month).” They also point out that covid-related parts shortages are also hitting the plants in Thailand where almost all NZ’s utes are sourced. For that reason, there’s every reason to believe utes might be scarce for several months to come.

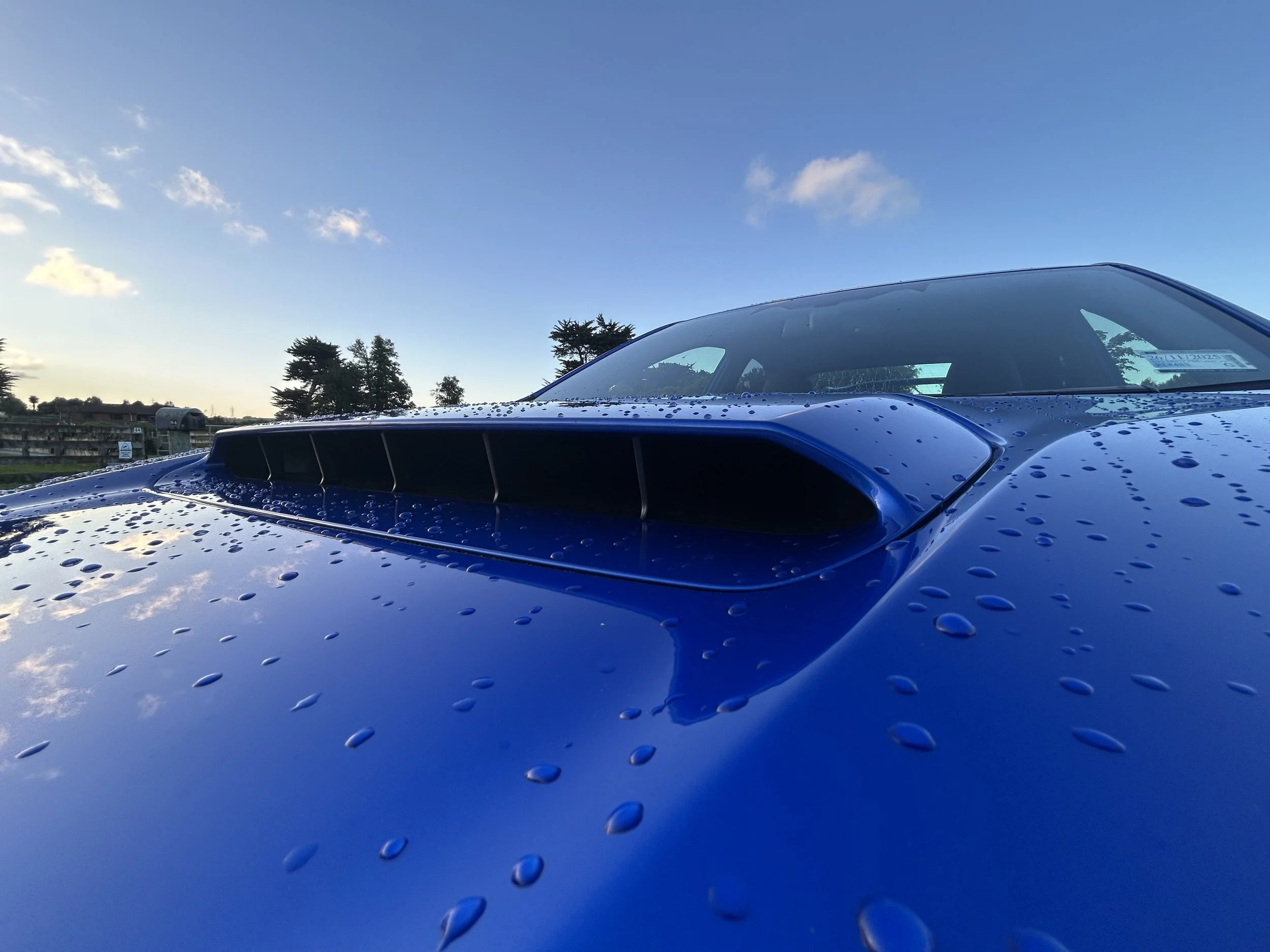

Another influence on April’s result is the Ranger being in runout. The strongest-selling ute for seven years and at times the country’s best-selling vehicle, is basically unavailable now in the outgoing T6 guise.

Just 287 were sold in April yet it was still the top-selling ute, followed by Hilux with 103 sales and the Nissan Navara, 85 moving off the yard.

May could also be a lean month for the Blue Oval’s star. Ford said today that the replacement T6.2 will be available from June and suggested it has 3000 forward orders.

Market share year to date, the Ranger still leads with a 21 percent slice and 4282 units, followed by Triton (21 percent, 4248) and then Hilux (15 percent, 3073).

Says the MIA’s chief executive, David Crawford, in a release this evening: “It is anticipated sales of utes will gradually recover as the year progresses.”

April’s new vehicle registrations count was down 25.7 percent, or 3377 units, on the same month last year. Year to date, though, the market is up 3.4 percent, or 1853 units.

Mitsubishi, whose elevation to market No.1 in March was a return to a title it last held in the mid-1980s, scored well in April. Its Outlander was the top-selling model, with 837 units, and the Eclipse Cross was the market’s third most popular choice, with 544 sold. The Toyota RAV4 sat between them, with 716 registrations. Mitsubishi’s success was based on the popularity of the PHEV variants of those cars.

Toyota regained the overall market leader with 1744 sales representing 18 percent market share followed by Mitsubishi with 17 percent (1623 units) then Suzuki (eight percent, 797 units). Mitsubishi has the leading market share year to date, with a 17 percent slice, whereas Toyota is second with 13 percent and Ford third, on nine percent.

The MIA says hybrid vehicle sales lifted with some purchasers having delayed their purchase to take advantage of a rebate they achieved from April 1. There were 2,145 hybrids registered, the RAV4 dominating with 525 units, followed by the Honda Jazz (461) and Toyota Corolla (198).