Chips are down for all

/The shortage of a tiny component is having a big effect on the new car industry, an organisation that represents their interests believes.

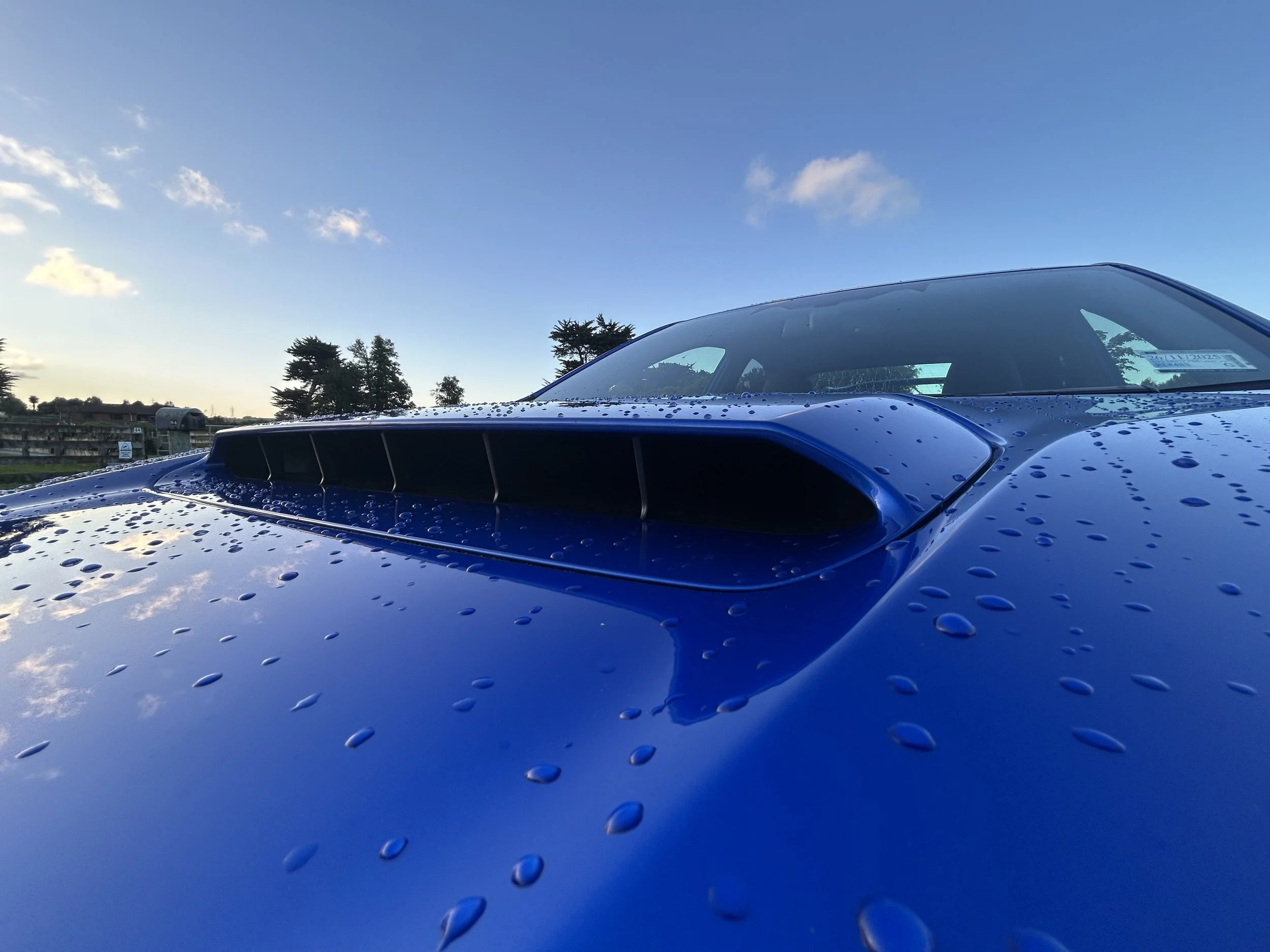

Semiconductors are now vital components in cars.

SOME new vehicle distributors here are contemplating cutting back on some advanced supplementary safety features.

This from the head of the organisation that acts on behalf of the industry, speaking in respect to the local market impact of a global shortage of computer chips.

Motor Industry Association chief executive David Crawford, pictured, says it’s too soon to gauge how bad the semiconductor scarcity could yet get and how long it might go on.

He believes some brands are on the cusp of initiating removing technology from New Zealand-bound cars due to the lack of easy availability of the thumbnail-sized components.

Features likely to be pulled are ancillary to the main safety devices relevant to independent crash testing agency ANCAP, whose subsequent star ratings have Government recognition.

However, any such move will nonetheless send a ripple effect in respect to New Zealand Transport because the RightCar vehicle website that displays these features will have to be revised, Crawford says.

“If suddenly some of these are not there then we are going to have to do some work to update the listings.

“I don’t know of any vehicles having arrived where we have to do that yet but it has been raised as a necessity.”

Whatever it is, the way you tell your story online can make all the difference.

Media in Australia recently reported that certain BMW and Mercedes-Benz cars sent to their market are set to lose some assistance features in the next production run, with buyers being refunded for this.

Those brands have not offered comment about the potential of this also occurring in NZ-bound cars.

Mercedes-Benz in Australia has identified some models it has coming will lose Pre-Safe, a system that triggers anticipatory occupant protection measures, such as moving seats and closing the windows/sunroof, if the vehicle detects an accident is imminent.

However, it has assured the standard suite of electronic aids such as active brake assist, stability control, active lane keep assist “and any ANCAP ratings are unaffected.”

No particular brands here are being identified but none have yet done anything, Crawford says.

However, he believes some are close, though he also enforces it’s not a unilateral strategy by any means.

In preference to ‘de-contenting’, some local marques are now considering reducing availability or even temporarily delisting some vehicles if their makers cannot deliver them to specification.

And with some “really popular models, the distributors are considering whether they should take any more orders for a while” because the consignment count is already so long.

MIA comment was sought in wake of market leader Toyota New Zealand fronting up about the issue, an after-effect of the Covid-19 pandemic.

When they closed factories last year, makers also cancelled orders from semiconductor suppliers.

Whatever it is, the way you tell your story online can make all the difference.

The car market unexpectedly boomed but now demand is surging far beyond capacity for supply. The shortage has not been helped by one of the biggest producers losing a factory to fire. It is crippling players in diverse industries, but carmakers have it the worst – just when demand for new cars - including in NZ – is soaring.

However, fewer vehicles are being produced. In North America, for instance, the January-March production has reduced by about 100,000 vehicles. Outputs from Europe, Thailand and Japan have also suffered.

This week Ford in the United States offered prediction that production for North America could halve between now and the end of June and suggested the shortage will result in a $US2.5 billion reduction in operating profit as it mothballs factories.

Crawford says it’s a tough situation he’s still coming to grips with.

“My understanding is that there is no quick resolution – it is taking much longer to resolve than everyone was hoping.”

Palmerston North-domiciled TNZ yesterday gave insight when revealing it has an astounding and unprecedented 11,000 forward orders for passenger and commercial vehicles – roughly equivalent to six months’ stock in normal market conditions - and has almost run out of local reserves. It says this is basically now because of the shortage.

TNZ has stated that it will not consider reducing safety features in Toyota and Lexus product.

Steve Prangnell, general manager of new car sales for the Palmerston North franchise, offered that other distributors are also feeling the pinch and might even be in a worse situation.

Crawford does not contest this. However, he says it hard to achieve a fully accurate picture.

There’s a degree of reluctance by some brands be disclose too much, least that’s seen as signalling a weakness that competitors might take advantage of. Also, it’s ultimately up to individual brands to state their specific positions and identify themselves. “I cannot get ahead of them.”

He says it’s not just the chip shortage that is causing hurt; some factories supplying NZ are still not back at full strength and shipping routes are frequencies are still not back to normal.

In regard to TNZ’s contention, Crawford said: “Put it this way, I don’t know who’s not in the same boat.

“I have heard from a number that they are facing some constraints. They are not being very explicit about the severity … I suppose everyone is being a little bit cautious about speaking about this.

“But, yes, it’s widespread and it’s more widespread than it was a few months ago.”