Electrics on rise but Ranger still king

/Latest battery cars lifted EV action but ‘ute tax’ also failed to hurt interest in Ford and Toyota pick-ups.

PRONOUNCED consumer swing toward new vehicles with some form of electrification occurred in 2022 but didn’t inhibit a type targeted by Government’s emissions legislation from maintaining top dog status.

Preliminary sales data for 2022 released today reveals a surprise of it being a very strong year for car sales despite stock shortages, with a count of 116,445 passenger types. Overall, the new vehicle market (light and heavy) came in at just 490 units below 2021, making it the second highest year since record-keeping began in the 1970s.

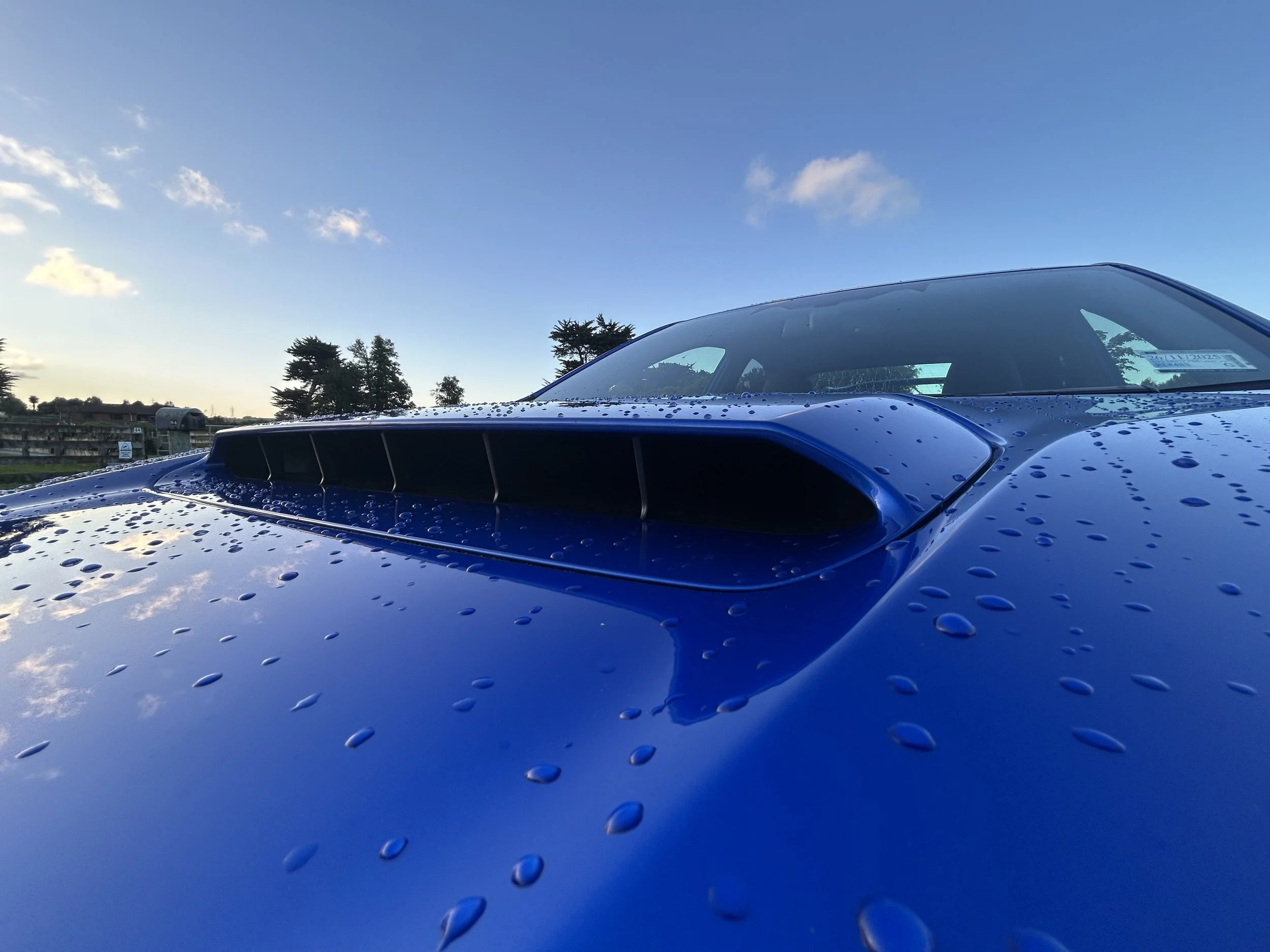

The information also identifies that demand for the Ford Ranger (above), favourite among the one-tonne utes that since last April have attracted penalties to offset the CO2 counts that exceed Clean Car expectation, was not as strong as in 2021.

Yet while that model’s annual tally was 1003 units down on the preceding year, it continued to dominate as the market’s top seller while the next best seller, Toyota’s Hilux, picked up 1357 extra sales, with a 9787 result.

The year’s third best-seller was the top of the passenger category the Mitsubishi Outlander, a sports utility that provisions in plug-in hybrid as well as pure petrol formats, with 9104 units.

Ranger has now held top spot for eight consecutive years and seems even more crucial to Ford than ever. Just 3635 of the 15,212 vehicles the Blue Oval sold last year were not Rangers. That’s a 76.1 percentage reliance, even higher than in previous years, though it has always achieved around seven in every 10 Ford sales.

By comparison Hilux accounted for 34.1 percent of Toyota’s commercial and passenger volume, against 28.8 percent in 2021.

Mitsubishi’s Triton, which has also been a big enough seller to be the third best-selling traydeck, appears to account for one in four sales for that brand.

Cumulatively, those three models achieved more share in 2022 than in 2021. It is conjected, however, that other utes did worse, as the commercial market – which the types dominate – is down.

How Ranger fares in 2023 becomes a priority question.

Ironically, the latest generation introduced last year is now selling, in its Raptor format (above), with a big thirst performance twin turbo V6 petrol whose emissions and thirst are significantly greater than the outputs from the historically market-preferred turbodiesel engines it also takes, an effect that leaves it even more at odds with the emissions reduction policy.

This has occurred as Ford has refined all its passenger cars, save the Mustang, to deliver with electric-assisted drivetrains and is about to launch the Mustang Mach-E, its first full electric, following up with a fully electric Transit van that already provisions with plug-in hybrid.

Asked to provide comment, Ford NZ said today: “The next generation Ranger has been a great success and customers have been very happy with the new powertrains, features and designs.

“We are looking forward to another successful year for Ranger but also across our entire range that includes an almost entirely electrified line-up.

“We had major supply issues in 2022 for a lot of our vehicles. A lot of that has been worked out and we are now getting things back online, including the Escape PHEV and hybrids, Focus and Puma Hybrids. We are also looking forward to the Mach-E arriving for customers very soon this year in NZ as well as the E-Transit.”

The utes’ dominance was not highlighted in comments from the data provider, The Motor Industry Association, which acts on behalf of almost all new vehicle distributors.

It has instead preferred to promote news that would be more palatable to Government policy and electric vehicle fans - that interest in vehicles with some form of battery-fed drive grew strongly last year, the favourites being those invigorated by the Clean Car rebate, which removes as much as $8625 from a car’s recommended retail if it prices below a $80,000 cut-off.

The MIA says 16,223 fully electric cars, 7259 plug-in electrics and 17,621 hybrid vehicles registered for the year. That represents a huge leap over 2021, when those categories respectively achieved 6897, 2482 and 13,794 registrations.

MIA chief executive David Crawford, who is about to retire from the role (with a successor having been found, though yet to be named), also commented that the total vehicles retailed with some form of electrification in their drivetrain grew from 23,173 units in 2021 to 41,103 units in 2022, an increase of 77 percent.

The year’s top-selling electric, with 4226 registrations was the Tesla Model Y (below) – a remarkable feat given it only arrived in third quarter – followed by the Model 3 sedan, from which it derives, with 2781 registrations. The third best-selling electric of 2022 was the BYD Atto 3, another model which only came on sale mid-year, with 1685.

Even so, Ranger was always a strong seller on monthly count, sometimes leading the tallies. That happened in December, when it achieved 1114 units, with Model Y placing next with 868 then Hilux and Model 3, with 615 and 413 units respectively.

Despite appearing to be the mainstream brand most affected by significant stock shortages, Toyota maintained its perennial spot as the market leader, albeit with 17 percent market share (28,727 units), a diminished slice on previous years.

It was followed by Mitsubishi, which benefited from strong supply to lead the market for the first half of 2022, with 14 percent (23,886 units). Ford placed third with nine percent market share.

The MIA contends that annual registrations of 116,445 passenger vehicles for 2022 was the strongest year on record, up 3.8 percent (4302 units) compared to 2021. It says electrified vehicles drove this outcome.

Overall, the new vehicle market (light and heavy) came in at just 0.3 percent (490 units) below 2021, making it the second highest year on record.

Says Crawford: “It is an outstanding result given rising interest rates, a challenging business environment and inflationary pressures dampening economic activity.”

His thought that the outlook for 2023 is nonetheless for a somewhat softer outcome, with businesses and private buyers tightening their belts seems supported by Anthony MacLean, a former industry involver, as local boss of MG, who now writes a blog, Boost Auto.

In comment made yesterday, prior to the availability of the annual data, he said new car sales don’t fully reflect the change that is happening in the market place.

“Many models are still on short supply with very long lead times. Ford dealers and Toyota dealers are delivering vehicles that were ordered six plus months ago.”

He also offered that retail enquiry has slowed dramatically as the cost of living crisis bites.

“Car owners tend to be house owners and there is a strong relationship between house values and car sales. Not only are house values slipping, but mortgage rates are jumping, meaning budgets are being squeezed two ways. This is bad news for sales of new vehicles; the market is tougher than registration data suggests.”