Clean Car – when success and failure combine

/A year on from full implementation, the legislation that set out to wean us from high CO2 vehicles is all but running on empty, with revision pending. While it has helped turn consumers toward electrics, we’re also sticking to the dark side.

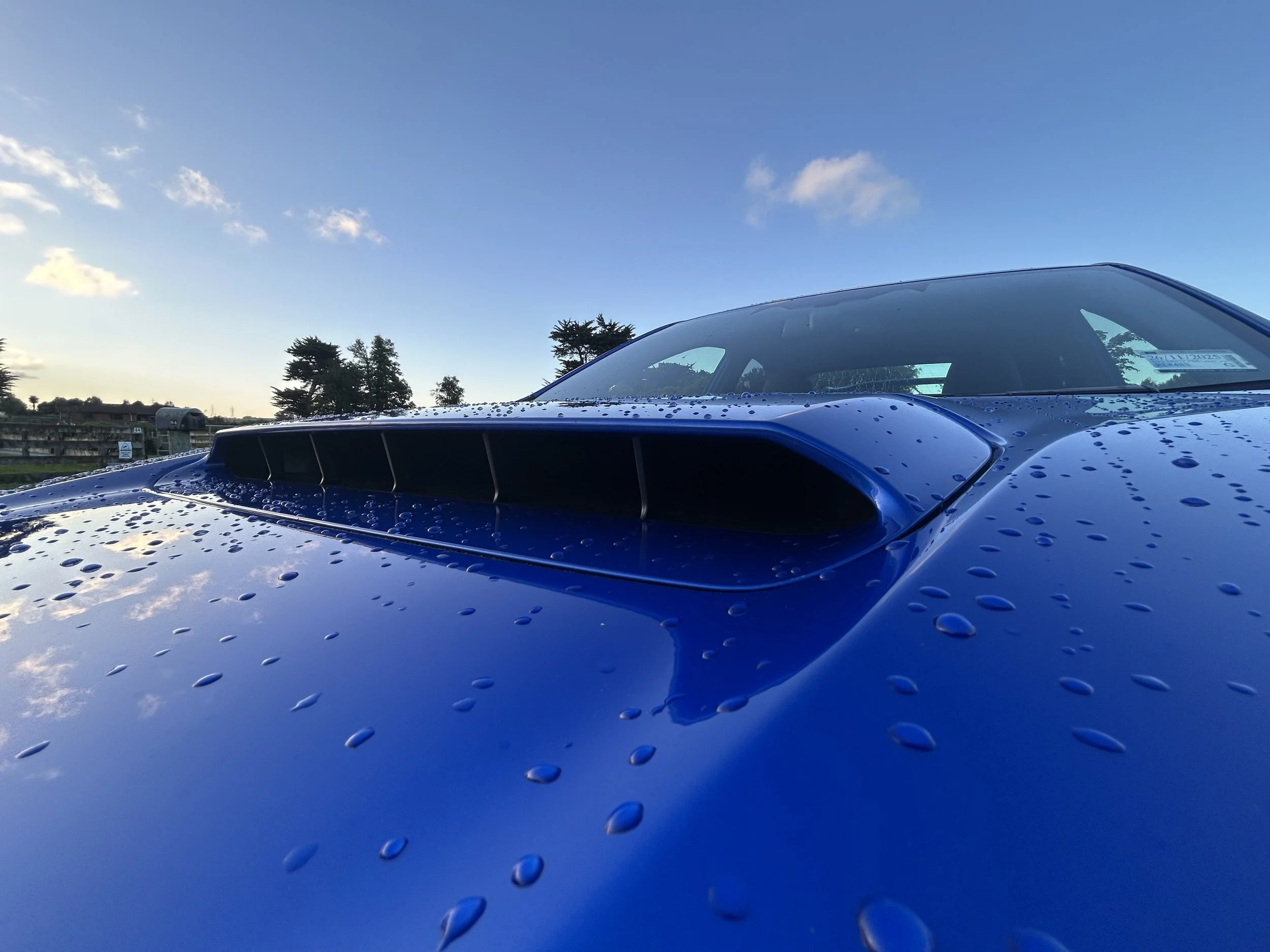

interest in new electric cars has risen considerably, yet the ford ranger (below) remains our favourite drive.

FEWER discounts, more penalties: That’s the prognosis of revision to a ground-breaking emissions regulation that has cleared the air, fizzed up popularity of zero emissions cars … and failed to inhibit Kiwi keenness for ‘dirty’ utes.

A review of Clean Car Discount, a year on from its full implementation, is under way.

Expectation it will bring sweeping changes has made the car industry jittery. And might also cause some on Government’s emissions’ improvement crusade to feel jilted.

Rethinking discounts and fees - lowering one, raising the other – seems a certainty, given the accelerating rate of rebate payout, peaking with a fat sum for eligible electric cars.

A system that removes up to $8625 from the price of a new clean vehicle selling for less than $80,000 (and $3450 for used import) as a discount paid for by levies of up to $5175 on the price of a polluting car has severely eroded the seeding fund of $304 million.

That pot presently holds no more than $98 million, and motor registrations data shows the income from Clean Car Discount penalties running well below the rate of pay out - $161m in fees against $367m in rebates. That’s a shortfall of $206m.

There’s also a flow rate difference; fees are known at the end of the month, whereas rebates take time to process and pay.

As sales of electrics, mild hybrid and, to lesser extent plug-in hybrids, keep growing, that take-up should logically only increase. The industry has been dubious about how long a scheme which transport minister Michael Wood sold as being ‘fiscally neutral’, it can remain effective. On current demand, how long before the fund is entirely depleted?

The review specifically addresses this and another concern: How to counter the Opposition’s avowed intent to repeal ‘ute tax’.

Industry-aimed publication, AutoTalk, believes big change is coming.

From considering industry paperwork, it thinks incoming tweaks will include a shift in the ‘zero-rating band’, the mid-zone for vehicles whose emissions are too high to win a rebate yet below penalty point. At present that zone is between 147 grams per kilometre to 192g/km. There’s talk, apparently, of reducing the high point to 150g/km. That would mean a lot of additional cars will be penalised at purchase.

It also believes the price limit for subsidies will be lowered and expects there will be some form of exemption for utes or light commercials.

Clean Car’s aim to achieve a world-leading CO2 reduction from passenger and light commercial fleet, within five years, still appears unchanged.

The discount scheme’s supporters cite success, from patent rise in interest in electrified and electric vehicles, saving of $100 million a year in fuel bills and better air quality. Non-profit electric vehicle organisation Drive Electric calculates CCD has removed around two million tonnes of CO2 and its chairman, Mark Gilbert, is now calling on all political parties to do more to accelerate transition to clean transport.

Clean Car has clearly accelerated interest in fully electric new cars. There are now almost 76,000 EVs on the road, the majority new, most with latest technology – the reign of the clapped-out, early gen import Nissan Leaf is over.

That doesn’t mean the country is at tipping point toward favouring electric. Though EV and hybrids have grown to account for more than a third of new registrations, the population presents as a modest imprint on the overall fleet of close to five million; a side effect, no doubt, of NZ being seventh in the world for rate of private ownership of cars per capita. BYDs, Hyundais, Kias and white Tesla Model 3 and Model Ys seem to be everywhere, but the journey has barely begun.

An abiding issue, however, is that a type of vehicle that earns colloquial recognition is still selling well. Look at the monthly sales stats and, as much as there’s occasional top trumps success by those global power brokers BYD and Tesla, you’re more often to see one diesel utility lead the pack. Ford’s Ranger is a juggernaut.

They don’t call it ‘ute tax’ for nothing. Diesel commercials are high CO2 contributors. Van sales have slid; utes less so. Some shift out of rear-drive types, potentially to more fuel-efficient hybrid sports utility wagons, has been seen. But the historically stronger buy-in - high-spec, $70,000-plus doublecab diesel automatic four-wheel-drive - from the two most favoured brands have largely rocked on.

Ranger wrapped up 2022 as New Zealand’s best-selling new vehicle, its seventh straight year on top. Buyers of those, and the second choice Toyota Hilux, seem to have decided ‘ute tax’ penalty pain, of no less than $2000 and up to the maximum $5175, can be lived with.

Will Government raise the bar to a point where it cannot? That’d likely take the Ranger Raptor – whose super-sporty twin turbo petrol V6 performance is offset by it being the category Kohinoor for price and the top CO2 contributor among one-tonners - above $100k. Would that be a tipping point?

What also hasn’t fully factored in yet is an ancillary income source to CCD. Enacted on January 1, the Clean Car Standard hits distributors of high emissions in the pocket – and rewards those with low or no CO2 with credits that can be traded between distributors.

From June 1 trading of credits and payments of debits for ‘pay as you go accounts’ kicks in. That side should have also started at the beginning of the year, but sorting the system to handle payments for the debits has been troublesome. Fleet average accounts will trade from January 1 next year.

What has also hurt the Clean Car Discount is consumer and distributor enthusiasm to involve with it. Many new EVs have cannily priced to be rebate-earners. Uptake of those has gone bananas. But also enjoying the moment are mild hybrids, which don’t mains replenish but still deliver CO2 reduction, are more price-accessible and find favour as a more accommodating technology.

Distributors won’t be happy if the rebates system is throttled back so that only fully electric vehicles and plug-in hybrids continue to achieve support and traditional hybrids and low-emission combustion vehicles that currently qualify are expelled.

The biggest opponent of this is Toyota New Zealand. The first local distributor to commit to Clean Car’s principles relies very heavily on hybrids and achieves excellent sales; hence why it has refined its passenger car selection to have the technology that, of course, in introduced to the world in the late 1990s.

TNZ chief executive Neeraj Lala’s thoughts about this and other Clean Car actions and perceptions have become increasingly impassioned.

Suzuki New Zealand, which a year ago threatened – without acting out it – to pull from the new car market over Clean Car, is also entwined in argument.

The specialist in small economical cars has benefitted from the discount yet has felt pain from the Standard, as result of how CO2 calculations are made.

On March 16, at an introduction for a version of the popular Vitara crossover that gives it hybrid capability for the first time, the Whanganui-based business’s chief executive Tom Peck erroneously predicted the exclusion of mild hybrids and low emissions internal combustion cars would be introduced on April 1.

Nonetheless, the industry remains no less edgy now than it was last week. It’s not just new vehicle sellers, but also those who sell vehicles sourced used from overseas, as they also have to comply.

In hindsight, Government thinking it could slice utes out of the scene so easily was daft.

The addiction is way too strong; as soon as ‘ute tax’ was in the wind, fans staked allegiance all the more. It hit crescendo in March 2022, the last month before the legislation hit. Mitsubishi Triton, with 2266 registrations, Ranger on 1933 and Hilux with 1580 units. We’d never seen anything like it before, or since.

Demand in April and May last year then fell off. A victory for CCD? No. Simply, stockpiles were exhausted. Also, this period uncannily coincided with Ranger’s model cycle change.

The pre-April action was brilliant for Ranger run-out. Normally, it’s hard to shift old stock when customers know new, improved fare is coming. In this instance, any ute escaping penalty was a ute worth having.

Every outgoing Ranger went. For around six weeks, dealers had nothing to sell. When the new line landed in June, it was Christmas; 3000 forward orders. And it hasn’t slowed since. Ranger sauntered into being top dog new vehicle for the year. This year it’s kept momentum going. Last month was huge, with 1333 registered. No other vehicle came close.

Hilux also continues to perform well, even though availability is being purposely throttled back by Toyota New Zealand, and with Triton now heading toward model change, who’s to say Mitsubishi isn’t about to kick in its own full runout campaign? Already it’s among those types subject to a distributor’s ‘but trhe ute, we’ll cover the tax’ campaigns.

Don’t think Ford NZ doesn’t understand its societal duty. A plug-in electric Transit van with a fully battery-driven type coming and announcement now of a fully electric small van remind it’s setting up to be a big player for commercial electric choice.

An update all its passenger models – save the Mustang - to mild or plug-in hybrid, with Puma set to go full electric next year, and imminent sale of the controversially battery-wed Mustang Mach-e show the passenger space isn’t being ignored. There’s thought Escape, a crucial volume passenger model out of Europe, and/or its Capri coupe spin-off – both on Volkswagen’s MEB underpinning – might not be as out of reach as was first stated, either.

At same token, they’re a business. Critics of Ranger might call it a toy, but plenty out there use it as a tool. Either way, the degree of consumer desire means it is not a vehicle that can be simply set aside. Calling it vital to Blue Oval business is understatement. It’s been the rock for years and last year claimed an unprecedented 75 percent of total Ford NZ volume. By comparison, Hilux secured just under 35 percent of Toyota sales share, which TNZ openly stated was too much.

The latest Ranger has been irresistible for good reason; it’s the best in its class. Yet utes aren’t icons of efficiency. Within the Ranger family, just the carryover 2.0-litre biturbo is cleaner than before, but only marginally, and its outputs remain well above the penalty cut-off. The new-to-type V6s all the moreso.

Ford is clearly making the most of whatever time it senses it has left for Ranger to rampage without extra restriction. Since last year’s launch, the line-up has grown.

The latest addition is one that might suggest as a pitch for redemption. By running a version of the biturbo designed to meet a European emissions standard higher than NZ demands, the Wildtrack X delivers with the lowest (though still high enough for penalty) CO2 count yet for a Ranger. A sign of better things to come? Perhaps. Or perhaps not. The eco-conscious Ranger buyer’s choice is a short-term opportunity, with just 300 coming.

Utes will one day clean up through adopting electric involved drivetrains; but for the category favourites, that day might not be near. All sorts of potentials are suggested.

Last week Toyota in the United States indicated its Tacoma, a Hilux sister ship, will adopt a hybrid drivetrain. Having previously suggested new-generation Triton (from which a new Nissan Navara will be spawned) will go plug-in or mild hybrid, Mitsubishi is now suggesting it might just bypass those technologies and go full electric. What’s also apparent, though, is that this option won’t figure when the vehicle initially releases, late this year or early next. Ford has said Ranger will accommodate a battery, but seems mnore keen on PHEV. Yet Volkswagen reckons it can transform new Amarok, a re-engineered Ranger, into a wholly electric model. In time.

At present, the only one to go there is from China; an LDV which has limited range and performance, sacrifices load capability and is purely rear-drive, with its motor slung precariously close to terrain. Low take-up suggests ute faithful are awaiting better.

Realistically, the only immediately effective tool to diminish ute interest is increasing the penalties. None but the very brave might want to play that card before the October 14 general elections. Argument about the national necessity has never diminished and might be stronger given how useful utes have been for Cyclone Gabrielle clean-up duty.

The Standard will surely alter the scene; even if consumers remain keen for the naughty stuff, distributors might be so about provisioning it. Those that can’t meet average CO2 targets across the vehicles they sell have to pay fines, those that do gain credits that can be used as a buffer for impending fines or traded to other brands.

The Standard will assuredly leave blood on the floor; it could kill the Ranger Raptor V6 altogether and even force some brands out of the market. It’s a tightening noose.

Fleet milestones this year set at 145g/km for cars and 218.3g/km for utes. Those will drop each year, culminating at 63.3g/87.2g respectively from 2027. Penalties are set at $45 per gram of carbon dioxide (half that for used cars) multiplied by the sum of emissions above the target from every vehicle sold.

When will we know about the Clean Car Discount revisions? Bets are now on June 1, or sometime in July. There’s absolute certainty something will occur before the October 14 general election.

When the discount fund might exhaust is hard to pinpoint; what happens if it does less so.

Waka Kotahi Land Transport New Zealand, which oversees Clean Car, has always advised that, if funds are exhausted at any given time, rebates will not be paid out. Also, once the rebate scheme restarts, only vehicles registered from the restart date that meet the eligibility requirements will qualify for a rebate.

That’s a point requiring consideration. Common belief about rebates enacting immediately after a candidate vehicle is registered isn’t quite right. It’s true a vehicle becomes eligible then, but it’s not until the paperwork is submitted and processed that the money is effectively claimed. Conceivably, a car that’s registered, in use and awaiting a rebate could miss out if the fund is closed. Not a pleasing scenario for those driven to do the ‘right’ thing.